Bitcoin mining is renowned for its energy intensity. As of March 25th, 2023, Bitcoin miners’ power demand amounts to 15.4 gigawatts (GW). In the Bitcoin network, so-called miners compete in a computational puzzle to add blocks to the chain and validate coin ownership and transactions included in the blocks. To participate in the process, miners use specialized hardware devices which consume electricity.

And while scholars and Bitcoin proponents agree that miners consume vast amounts of electricity, opinions regarding the climate impacts of Bitcoin mining deviate fundamentally. Critics view Bitcoin’s electricity consumption as a calamity, while proponents perceive it as a feature rather than a bug. A growing body of academic studies compares Bitcoin’s carbon footprint to the emission levels of mid-sized countries. Concurrently, Bitcoin proponents highlight potential climate benefits from grid balancing services, support of renewable energy expansion, methane emissions reductions via flare gas utilization or sealing of orphaned wells, and use of waste heat from mining hardware for ancillary activities.

Notably, during the winter storm Elliott in North America in December 2022, Bitcoin miners curtailed as much as 100 Exahashes per second (EH/s) – equivalent to 38% of the total Bitcoin network hashrate on that day. This number provides empirical evidence that at least 38% of all Bitcoin mining activity was located in the U.S. and Canada by December 2022.

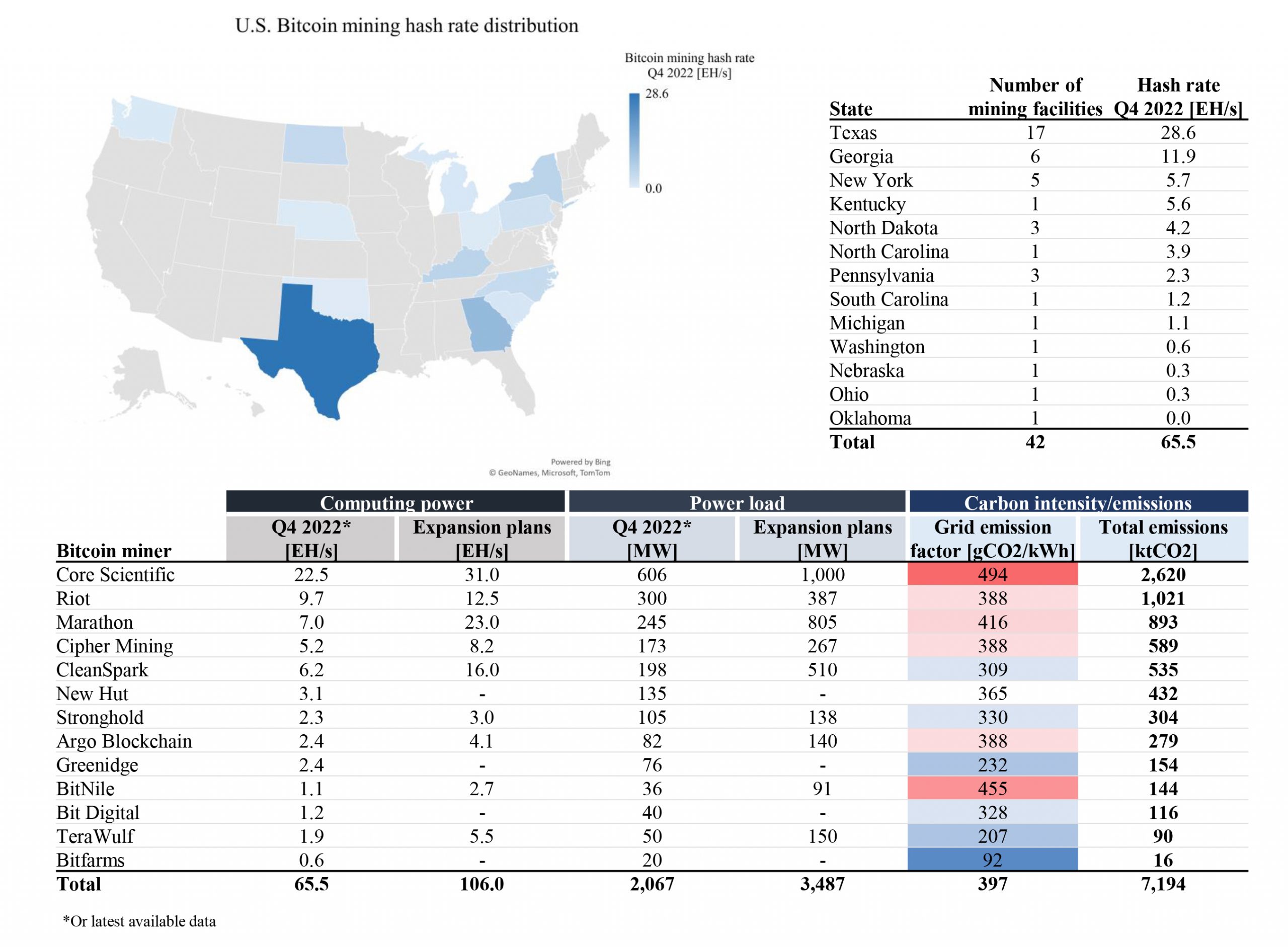

We validate arguments from both sides and provide empirical evidence for the extent and energy sources of Bitcoin mining in the U.S., based on data from 13 publicly listed mining companies that account for one-fourth of the total network hashrate as of the end of 2022. Using the grid average emission factors, we find that the carbon intensity of electricity consumed by the 13 miners included in our analysis of 397 gCO2/kWh is nearly equivalent to the U.S. grid average of 387 gCO2/kWh. Furthermore, we find that the annual emissions of 7.2 MtCO2 caused by the 13 analyzed publicly listed miners in the U.S. alone surpass the carbon emissions of the State of Vermont.

These findings, based on grid average emission factors, stand in contrast to industry claims that the majority (58.9%) of Bitcoin mining is fueled by sustainable energy as the share of non-fossil electricity from renewables (21.5%) and nuclear (18.2%) in the U.S. generation mix is significantly lower. At the same time, we find that the potential climate benefits of Bitcoin mining also warrant closer attention. Financial incentives of the Bitcoin network may, for instance, subsidize the sealing of orphaned and unplugged wells, and thereby, reduce methane emissions at scale.

The growing transparency on locations and energy sources of large publicly listed Bitcoin miners highlights the value of disclosure obligations and may help dismantle unsupported industry claims, improve assumption-based academic models, and point regulators to areas where Bitcoin mining may bring climate co-benefits.

Further Reading:

CEEPR WP 2023-11

About The Authors

|

Christian Stoll is a co-founder of CCRI – Crypto Carbon Ratings Institute and a research affiliate at the Center for Energy Markets of the TU Munich and MIT CEEPR. His current research focuses on the sustainability of digital assets. Christian has been a CEEPR visiting student repeatedly in the past since 2015 and received his Ph.D. from TU Munich in 2019. Before and after his Ph.D. leave, he worked as a management consultant in Europe and the Middle East. Contact: cstoll@mit.edu. |

|

Lena Klaaßen is a Ph.D. student in the Climate Finance and Policy group at ETH Zurich. She is also a co-founder of CCRI – Crypto Carbon Ratings Institute. Her research focuses on energy finance for the low-carbon transition as well as the environmental impact of companies and digital technologies. |

|

Ulrich Gallersdörfer is a co-founder of CCRI, a company providing intelligence and data for cryptocurrencies, blockchain, and related technologies. His research focuses on blockchain technology and adjacent fields. Formerly, he was a research associate at the Department of Informatics of the Technical University of Munich. |

|

Alexander Neumüller is a Research Associate at Cambridge Centre for Alternative Finance (CCAF), where he leads the Cambridge Digital Assets Programme’s research efforts on the climate impact of digital assets. With years of practical experience in the crypto ecosystem, spanning from cryptocurrency mining to interacting with DeFi protocols and dealing with NFTs, he brings a wealth of crypto-related knowledge to his research. Before his tenure at the CCAF, he held multiple roles in traditional finance, including corporate banking, equity trading, and asset management. |